Intel’s Recovery: Spotlight on the Future of Its Foundry Business

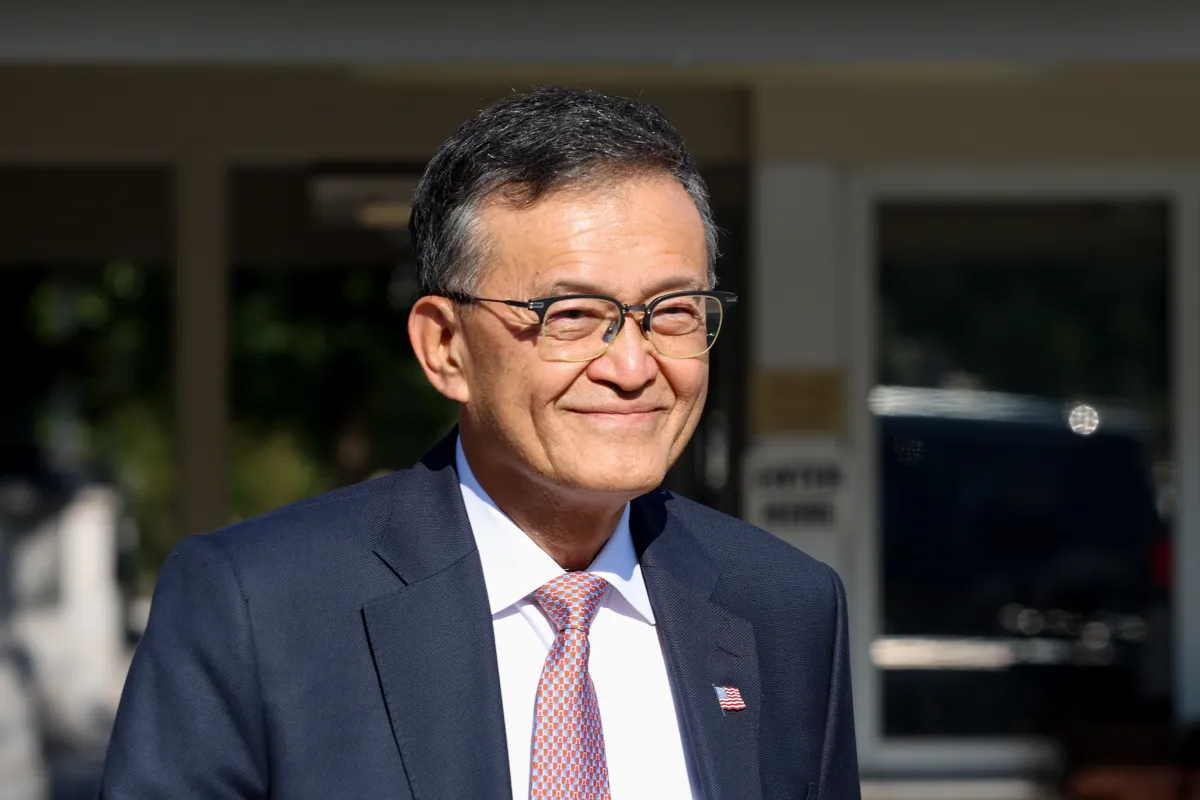

Intel has recently turned heads with its latest earnings report, which exceeded Wall Street projections and offered a fresh glimmer of hope amidst its challenges. With a substantial net income of $4.1 billion and rising revenues, Intel is strategizing its path to recovery. Under the leadership of CEO Lip-Bu Tan, the company is making bold moves to reshape its fortunes, and there’s much we can learn from its ambitious approach.

Strong Financial Results

Intel’s quarterly revenue rose by $800 million, totalling $13.7 billion—a positive shift compared to the previous year’s $12.9 billion. This change reflects a remarkable turnaround from the $16.6 billion loss reported in the same quarter last year. These figures not only signify a brighter financial landscape but also demonstrate the impact of strategic investments and cost-saving measures.

- $20 billion added to Intel’s balance sheet in Q3.

- Significant contributions from recent investments:

- SoftBank: $2 billion

- U.S. Government: 10% equity stake

- Nvidia: $5 billion investment

Key Investments Driving Growth

The recent influx of investments is a crucial factor in Intel’s recovery narrative. Just last month, the company secured high-profile backing:

- SoftBank’s $2 billion investment signals confidence in Intel’s potential.

- The U.S. government took an unprecedented equity stake, contributing to a total of $5.7 billion received thus far from planned investments.

- In September, Nvidia further cemented its partnership with Intel through a $5 billion stake aimed at collaborative chip development.

During a recent earnings call, Tan emphasized how these financial boosts will allow Intel to execute its strategies with renewed vigor, benefiting from the trust placed in the company by significant stakeholders.

The Foundry Business

Despite this surge in revenue and investments, Intel’s foundry business, which manufactures custom chips for clients, remains a focal point of concern. Although Tan has initiated substantial layoffs to streamline operations, the future of this division remains uncertain. The Trump administration has made it clear that its investment is conditioned on Intel maintaining its foundry operations for at least five years.

Market analysts are closely monitoring this segment for signs of recovery and sustainability. They believe that while Intel has the cash to turn around, it needs a solid strategy focused on revitalizing its chip manufacturing capabilities.

Tan believes that Intel’s foundry is “uniquely positioned” to respond to the escalating demand for chips, yet he refrained from providing extensive details on strategic plans. He did, however, highlight the importance of building trust and adapting to diverse customer needs as central to their approach.

Moving Forward with Confidence

As Intel navigates this complex landscape, it’s clear that its recent investments and financial recovery are just the beginning. The path ahead may be intricate, but with visionary leadership and robust support, Intel can harness its potential to emerge stronger.

For those invested in technology and innovation, Intel’s story serves as a reminder of resilience and reinvention. As we watch this semiconductor giant reshape itself, it’s an opportune moment to reflect on how we embrace change in our own lives.

Are you ready to embrace transformation in your journey? Join Intel in moving toward a bright future—because when we combine ambition with strategy, anything is possible!